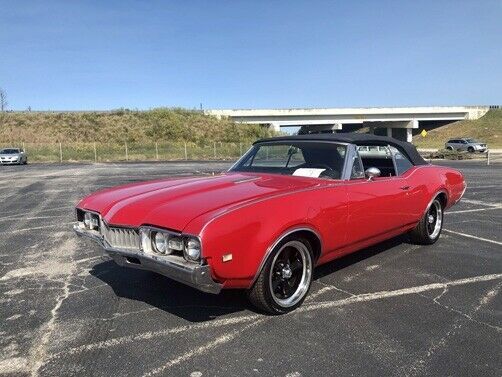

1968 Oldsmobile Cutlass 46902 Miles Red/Black

Price: US $19,988.00

Description:

1968 Oldsmobile Cutlass

Offered for sale is this good looking 1968 Oldsmobile Cutlass Convertible. This car just came in from Texas and is ready for her new owner. She starts right up every time and sounds great. Good looking Paint, Top and Interior. It is a Power Top, Power Steering and Power Brake car. The engine compartment is nice and clean. Nice wheels and tires. Call for more info 864-642-0804.Vehicle Details:

- Condition: Used

- Make: Oldsmobile

- Model: Cutlass

- Type: --

- Year: 1968

- Mileage: 46902

- VIN: 336678M435299

- Color: Black

- Engine size: --

- Power options: --

- Fuel: Gasoline

- Transmission: --

- Drive type: --

- Interior color: --

- Options: --

- Vehicle Title: -- Want to buy? Contact seller!